child care tax credit portal

And Made less than certain income limits. Check if youre enrolled to receive payments Unenroll to stop getting advance payments Provide or update your bank account information for monthly payments starting with the August payment Child Tax Credit Eligibility Assistant Check if you may qualify for advance payments.

Over 50 Of Children Will Have To Go Through The Event Of Their Parents Divorcing Here Are More Percentages And Statistic Divorce Divorce And Kids Infographic

Access resources to help child care businesses.

. The Update Portal is available only on IRSgov. If you did not file taxes you only need to take a few simple steps to get the Child Tax Credit. To learn more about recordkeeping requirements see our Checklist for child and dependent care expenses.

The Families First Coronavirus Response Leave Act FFCRA can help most businesses even those with only one owneremployee to get compensation for time off because of COVID quarantine and taking. You will need the following information if you plan to claim the credit. Federal Child and Dependent Care Credit.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you. The Department of Social Services recommends the following free options.

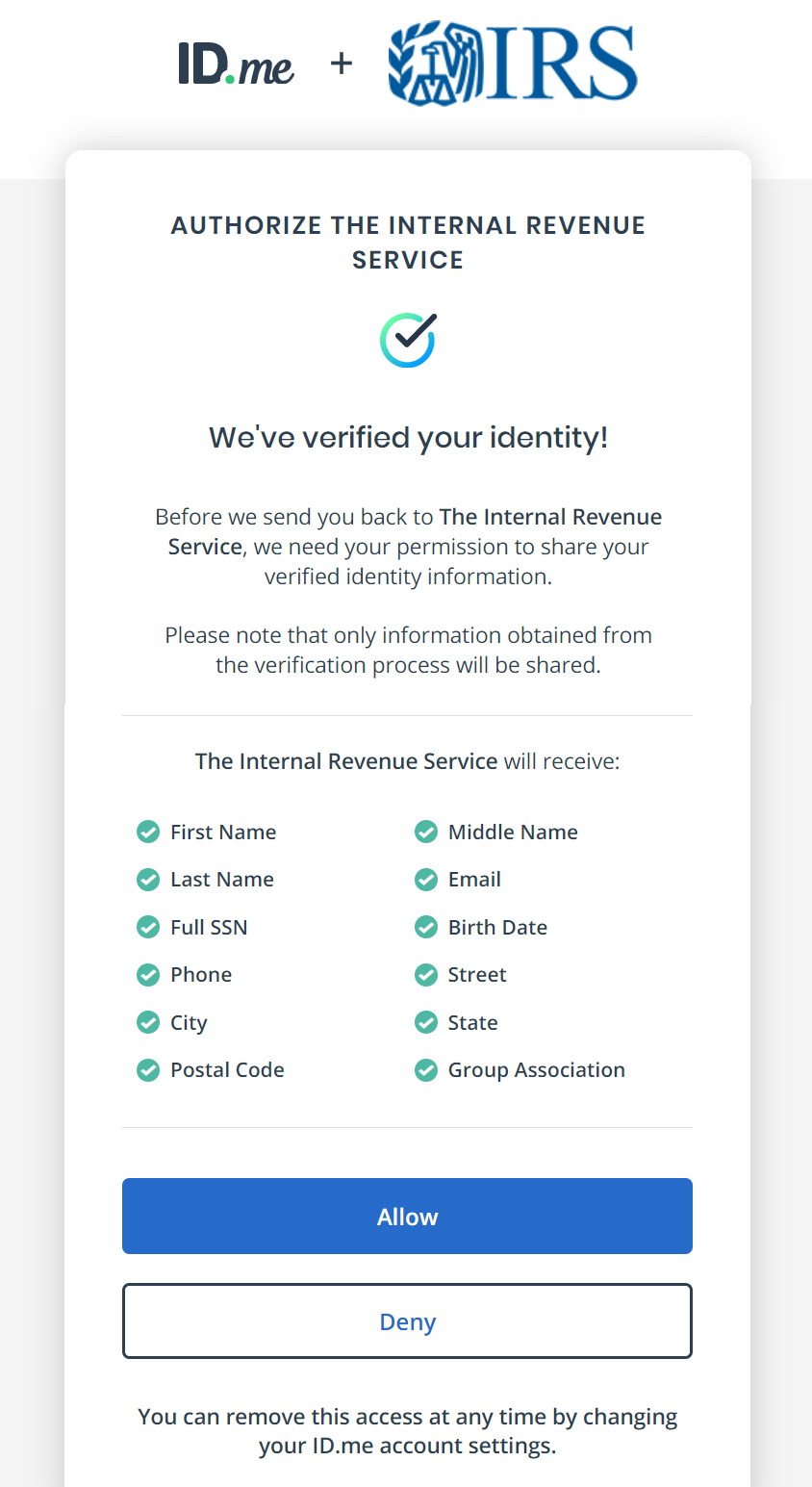

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Getting the Child Tax Credit if you havent filed tax returns.

Click the blue Manage Advance Payments button. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school. Visit the IRS website to access the Child Tax Credit Update Portal.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. This secure password-protected tool is easily accessible using a smart phone or computer with internet. Even if you do not normally file tax returns you are still eligible to claim any Child Tax Credit benefits you are eligible for.

Are parents who took the child tax credit typically having to pay back in. June 28 2021. The United States federal child tax credit is a partially-refundable tax credit for parents with dependent children.

You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. Additional information See Form IT-216 Claim for. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number.

Cash receipts received at the time of payment that can be verified by the department. If you received direct deposits to your bank account. You will get the Child Tax Credit automatically.

This goes up to 1000 every 3 months if a child is disabled up to 4000 a year. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits. Eligibility for advance payments Bank account and mailing address Processed payments.

The Employee Retention Tax Credit ERTC is a great opportunity for child care businesses with W-2 employees. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. In the year 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per child under the age of 6 and 3000.

If you get Tax-Free Childcare you. The IRS said that the password-protected CTC Update. Simplified Tax Filing to Claim Your Child Tax Credit.

If you did not file a tax return for 2019 or 2020 you likely did not. The tool also allows families to unenroll from the advance payments if they dont want to receive them. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. If you got advance payments of the CTC in 2021 file a tax return in 2022 to claim any. The Child Tax Credit CTC provides financial support to families to help raise their children.

At first glance the steps to request a payment trace can look daunting. If youve already registered you can sign in to your childcare account. Check mailed to a foreign address.

The federal Child and Dependent Care Credit helps families pay for child care for children under age 13 or for care of dependent adults. Due to a change to the federal credit working families could get back up to 4000 in care expenses for one qualifying person and up to 8000 for two or more qualifying people. Throughout 2021 they received 3000 and will claim the other half on their tax return.

View the Child Tax Credit Update Portal Use this tool to review a record of your. Here is some important information to understand about this years Child Tax Credit. Making the credit fully refundable.

This tool can be. Called the Child Tax Credit Update Portal the tool allows people to un-enroll from the tax credit before the first payment is made on July 15. It provides 2000 in tax relief per qualifying child subject to an earned income threshold and phase-in.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. It also made the. Canceled checks or money orders.

File a 2021 tax return by April 18 2022 to claim the CTC for 2021. Youll need to print and mail the. You can use it.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. We file separately and its saying we owe 13. Child Tax Credit Portal Use this tool to.

We got the child tax credit and have two kids over 6. You can use the IRS Child Tax Credit Update Portal to view your payment history and verify that a check has been mailed to you or that you have received direct deposits. The Child Tax Credit provides money to support American families.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. In 2022 they will file their 2021 return report the amount they received and claim the remaining half of their tax credit 3000.

Payroll Tax Prep Tax Preparation Payroll

Www Myfes Net Sgalyean Badcredit Needcredit Identitytheft Restoremycredit Increasemyscore Bestc Credit Repair Financial Education Credit Repair Business

Clubbing Income Understanding What It Means How It Works And The Blunders People Make That Get Them In Trouble Income Financial Health Financial Management

Payroll Tax Prep Tax Preparation Payroll

Epf Contribution Of Employee And Employer Employment Contribution Pension Fund

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

An Investment In Knowledge Pays The Best Interest Investing Knowledge Personal Finance

Policyx Hdfc Life Sanchay Saving Investment Plan How To Plan Investing Insurance Investments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

I Will Create An Amazing Children Story Book Trailer For Your Kids In 2022 Kids Story Books Stories For Kids Book Trailer

Get The Most Out Of Your Money With Paypal Login On Www Paypal Com Login Git Rewards Credit Cards Cvs Enterprise Portal

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Payroll Tax Prep Tax Preparation Payroll

Xne Financial Advising Tax Preparation By Xne Financial Advising Llc Via Slideshare Tax Preparation Financial Social Media

Promotion Letter Format Template Google Docs Word Template Net Lettering Letter Templates Words

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax